Comprehensive Guide to How to Read a W2 Form in 2025: Essential Tips & Insights

How to Read a W2 Form: A Comprehensive Guide for 2025

Understanding how to read a W2 form is crucial for both employees and employers. The W2 form serves as an annual wage statement that provides essential information about an employee’s earnings and tax withholdings for the year. This guide will walk you through the details of the W2 form, including its components, how to interpret the data, and the tax implications associated with it. By the end, you’ll be equipped with the knowledge necessary to navigate your W2 and understand its significance in the tax filing process.

Understanding W2 Tax Form

The W2 tax form is one of the most important documents you will receive each year as an employee. This form is issued by your employer and summarizes your total annual earnings, the taxes withheld, and other important information needed for income tax filing. Understanding the W2 form’s categories and components is essential for accurate tax reporting and compliance. Noteworthy sections include your income in various boxes, which highlights federal income tax withheld, Social Security, and Medicare contributions.

W2 Form Overview

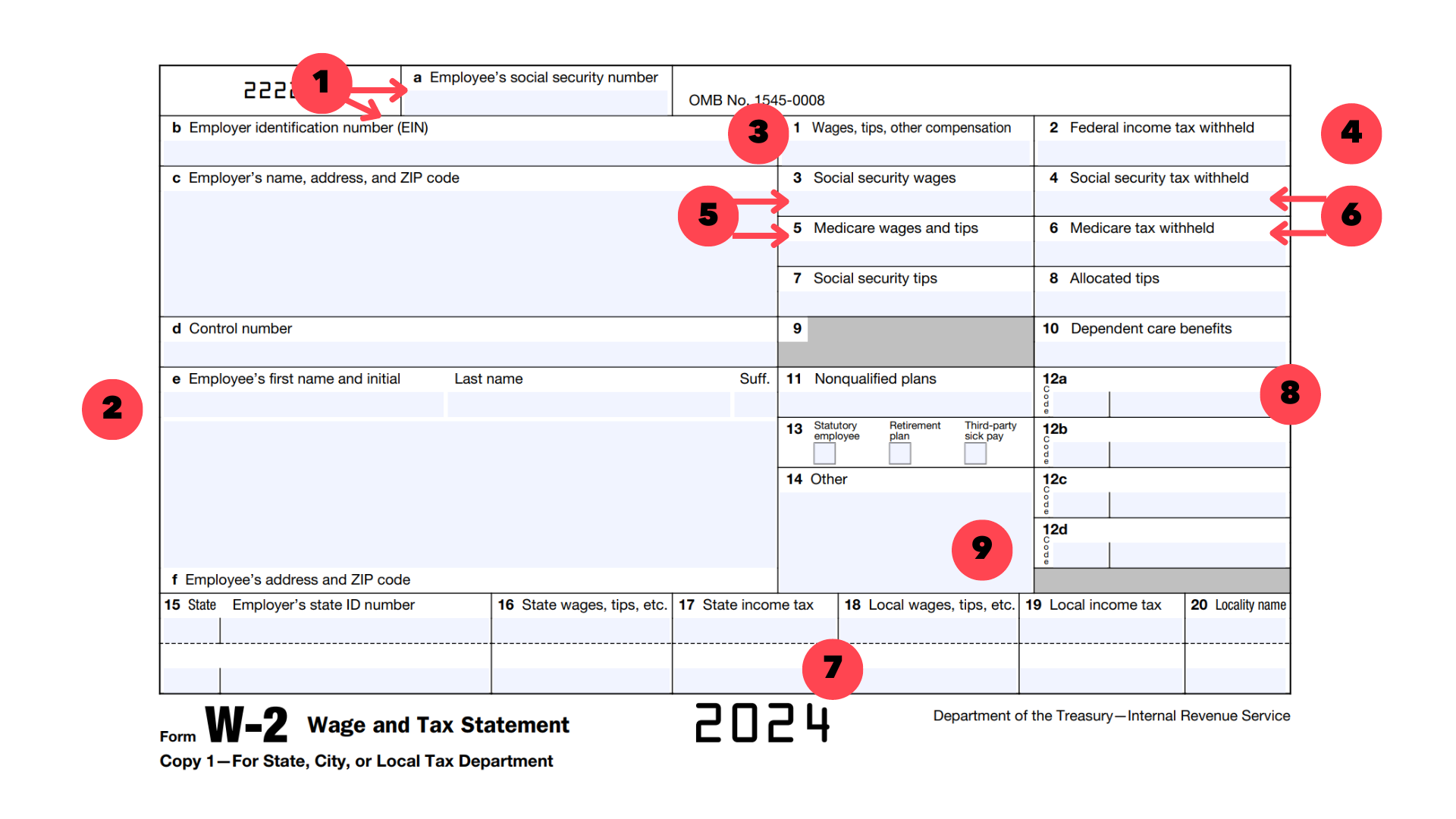

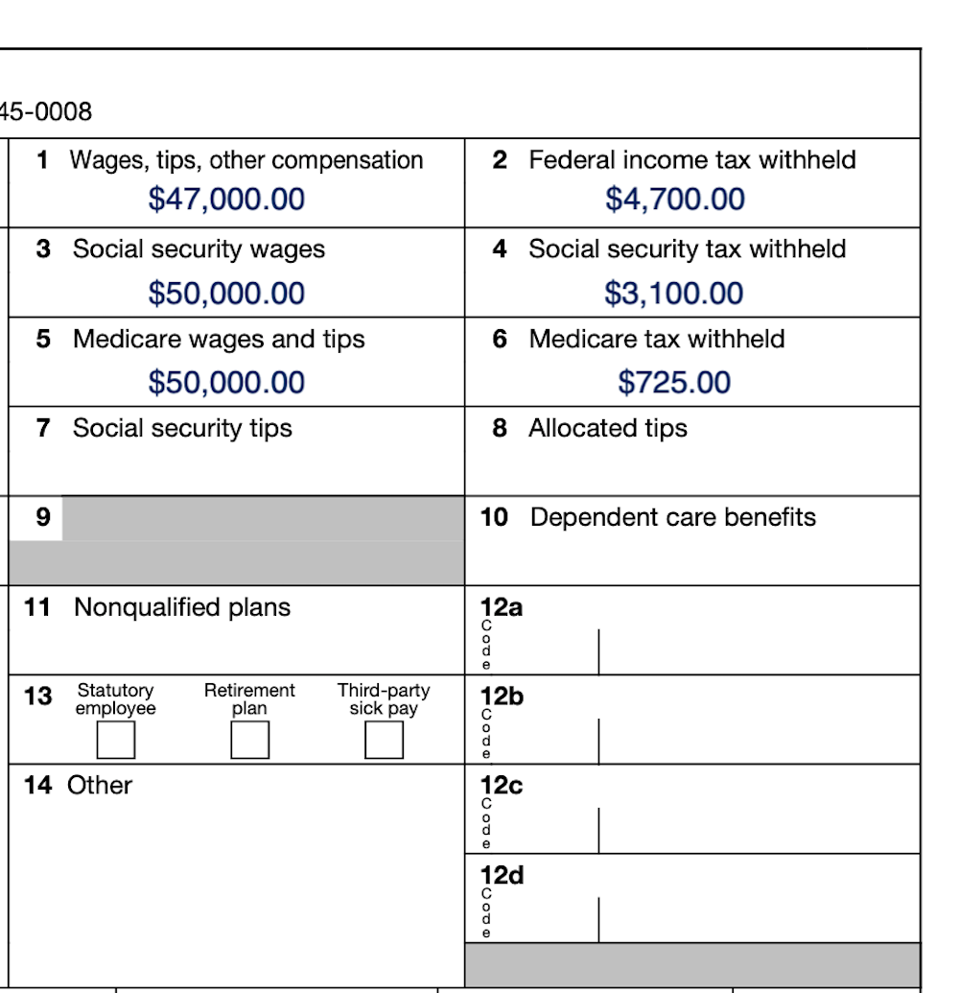

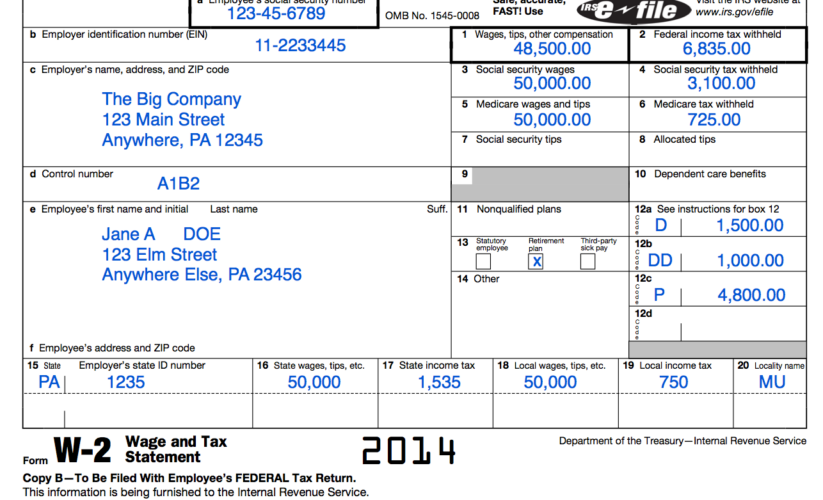

Every W2 form consists of various sections that cater to specific reporting needs. The primary purpose of the W2 is to provide the IRS with information about how much you earned and how much tax was withheld. Boxes on the W2 include wages, tips, and other compensation, which give you a clear picture of your total income. For instance, Box 1 indicates your federal taxable wages; Box 2 shows the total federal income tax withheld. Understanding these categories is pivotal for correctly filing your tax return.

W2 Form Components

Among the various components of the W2, paying attention to specific boxes is critical for accurate tax filing. Each box serves a particular purpose; for example, Box 3 reflects Social Security wages, while Box 5 indicates Medicare wages. To gain insight into your earnings and taxes, deciphering each box is essential. If there are discrepancies, it may affect your tax return significantly, leading to potential audits or penalties. Being diligent and proactive with your assessment can save headaches during tax season.

Benefits of the W2 Form

The W2 form provides numerous benefits not only for employees but also for employers. This structured document ensures that tax information is reported accurately, aiding employees in understanding their earning discrepancies and deductions. It simplifies the process of filing taxes and makes the complexities of understanding tax liabilities more manageable. Utilizing this form correctly can significantly ease your tax-related querying, providing clarity and confidence during the tax filing season.

W2 Form Instructions

Knowing how to fill out your W2 correctly can be daunting. However, understanding the instructions related to this form can alleviate stress. This section will delve into the essentials for filing correctly and avoiding common mistakes. With proper preparation, you can expedite your tax return process and ensure compliance with IRS guidelines.

W2 Form Completion

Completing your W2 form entails ensuring that all critical details about your employment and wages are correctly cited. From entering personal information, such as your name and social security number, to reporting the correct amounts in each box, proper attention to detail is imperative. Remember to double-check your information as inaccuracies could cause claims to be mistaken or lead to further complications when filing taxes.

Common W2 Form Mistakes

A frequent concern with the W2 form lies in inadvertent errors. These can stem from simple miscalculations or misunderstandings about what each box denotes. Ensuring that your reported wages match your final paycheck and that all Box entries align with your employer’s filings is paramount. When mistakes occur, correcting a W2 may require additional steps, including following the submission etiquette and possibly reaching out to your employer for clarification.

W2 Submission Tips

When it comes time to file your taxes using your W2, organization and preparation are key. Be sure to gather your W2 copies well in advance, allowing for any discrepancies or errors. You typically receive your W2 by the end of January each year, so don’t delay. Organizing your tax-related documents in advance can help steer clear of last-minute filing issues and complications. Moreover, ensure that you understand any unique state tax implications as they can differ from federal aspects.

Reading W2 Line by Line

A thorough understanding of your W2 form not only assists in tax preparation but also enhances your understanding of your financial health. Reading the W2 line by line can unveil significant insights into your earnings and deductions throughout the year. This in-depth exploration is crucial for comprehending what to include in your tax return.

Understanding W2 Boxes

Each box on your W2 conveys specific information crucial for tax reporting. For example, Box 1’s amount is your total taxable wages that are subject to federal income tax, while each categorized line provides additional information on state taxes or deductions. Many errors can arise from misinterpreting these boxes, leading to inaccurate filing. Therefore, a comprehensive coverage of what each box represents will empower individuals to make informed decisions during tax preparation.

Interpreting W2 Values

Interpreting the values presented within each box is essential for financial literacy and tax comprehension. Obtaining clarity on information, such as your insurance premium, retirement contributions, or employee abortion, plays a significant role. For instance, understanding how much Social Security tax you’ve paid this past year goes beyond the simple number; it helps you steuer qualifying for future benefits from the broader tax landscape.

Practical Example of Reading a W2

If you’re unsure how to navigate your W2, let’s look at an example. Suppose your W2 shows $50,000 in Box 1 (federal taxable wages) and $5,000 in Box 2 (federal income tax withheld). Utilizing this information, you can estimate your expected tax refund or balance owed depending on the overall context of your financial situation. Cross-referencing this with previous year’s tax returns can also offer machines to evaluate your tax liabilities effectively.

W2 Tax Reporting and Implications

For employees, understanding the tax implications of your W2 data is paramount. In this section, we explore the connection between your W2 figures and overall tax obligations, as well as common W2-related questions that arise for individuals during tax season.

W2 Tax Implications

The information on your W2 forms ultimately affects your overall tax returns. For example, a higher income level shown in Box 1 is likely to place you into a higher tax bracket, affecting how much you owe at the end of the year. Therefore, recognizing these implications allows individuals to better plan and prepare for any changes in their financial situation. Being aware of your earning trends can also help in evaluating potential tax strategies for the future.

W2 and IRS Compliance

Ensuring compliance with IRS regulations is imperative for any employee filing taxes using the W2. Whether you’re gathering your records for the subsequent year or preparing to file, incorporating the W2 into your tax strategy aids in aligning with legal obligations. Understanding the IRS filing rules and deadlines associated with W2 is therefore crucial to prevent late fees or potential audits due to incomplete filings.

What to Do With Your W2

Once you receive your W2, the next step involves not merely filing it away but leveraging its details to inform your tax filings. Analyzing W2 values, consulting relevant tax documents, and preparing other tax forms by utilizing software can further facilitate your connection between your W2 data and your overall financial health. Multiple tax strategies may come into play depending on how you read and interpret your W2.

Key Takeaways

- The W2 form is essential for understanding income and tax obligations for employees in the year following employment.

- Detail-oriented review of the W2 box entries can unveil essential insights about your earnings and deductions.

- Proper completion and submission of the W2 can ease the stress of tax season and prevent future issues with the IRS.

- Clarifying requirements and common errors related to W2 forms is vital for every employee to facilitate the filing process.

- Understanding your W2 profoundly impacts your financial literacy and positions you for tax preparedness.

FAQ

1. What is a W2 form and who needs it?

A W2 form is required for employees to report their annual earnings and taxes withheld. Employers must provide this form to their employees by January 31 of each year. Understanding W2 form details can help ensure accurate tax filings.

2. How can I obtain a copy of my W2?

If you haven’t received your W2 form by mid-February, contact your employer for a copy. They are required to provide you with your W2 to ensure sufficient federal and state tax reporting.

3. What if my W2 form has errors?

If you discover any mistakes on your W2, notify your employer immediately to correct the issue. An accurate W2 is crucial to prevent tax discrepancies and issues with the IRS.

4. Are there deductions available on the W2 form?

With various types of deductions applicable on your W2 form, such as retirement plan contributions or health premiums, comprehending these beneficiaries is essential. Understanding how to use W2 for deductions can enhance your tax return efficiency.

5. How does the W2 differ from a 1099 form?

While a W2 form is used by employers to report wages for employees, a 1099 form is often used for independent contractors and freelancers. Understanding W2 vs 1099 is key for clarifying your tax reporting requirements.

6. Are there specific W2 filing deadlines I should be aware of?

Yes, W2 forms must be submitted to the IRS by January 31st annually. Being mindful of W2 deadlines is crucial to avoid potential late fees and maintain compliance.

7. Can I access W2 forms online?

Many employers provide online access to W2 forms through payroll systems or portals. Keeping an eye on these resources can streamline your access to essential tax documentation.