Top 5 Essential Costs to Consider When Assessing How Much to Buy a House in 2025

Top 5 Essential Costs to Consider When Assessing How Much to Buy a House in 2025

As potential homebuyers look towards 2025, understanding the various costs associated with purchasing a home is crucial. Knowing how much you need to buy a house goes beyond just the sticker price. From mortgage down payments to closing costs, planning your home buying budget requires a comprehensive analysis of all expenses involved. This guide will explore the top five essential costs to consider to ensure you are financially prepared for your dream home. Let’s dive into these aspects to effectively navigate the real estate market analysis.

1. Mortgage Down Payment

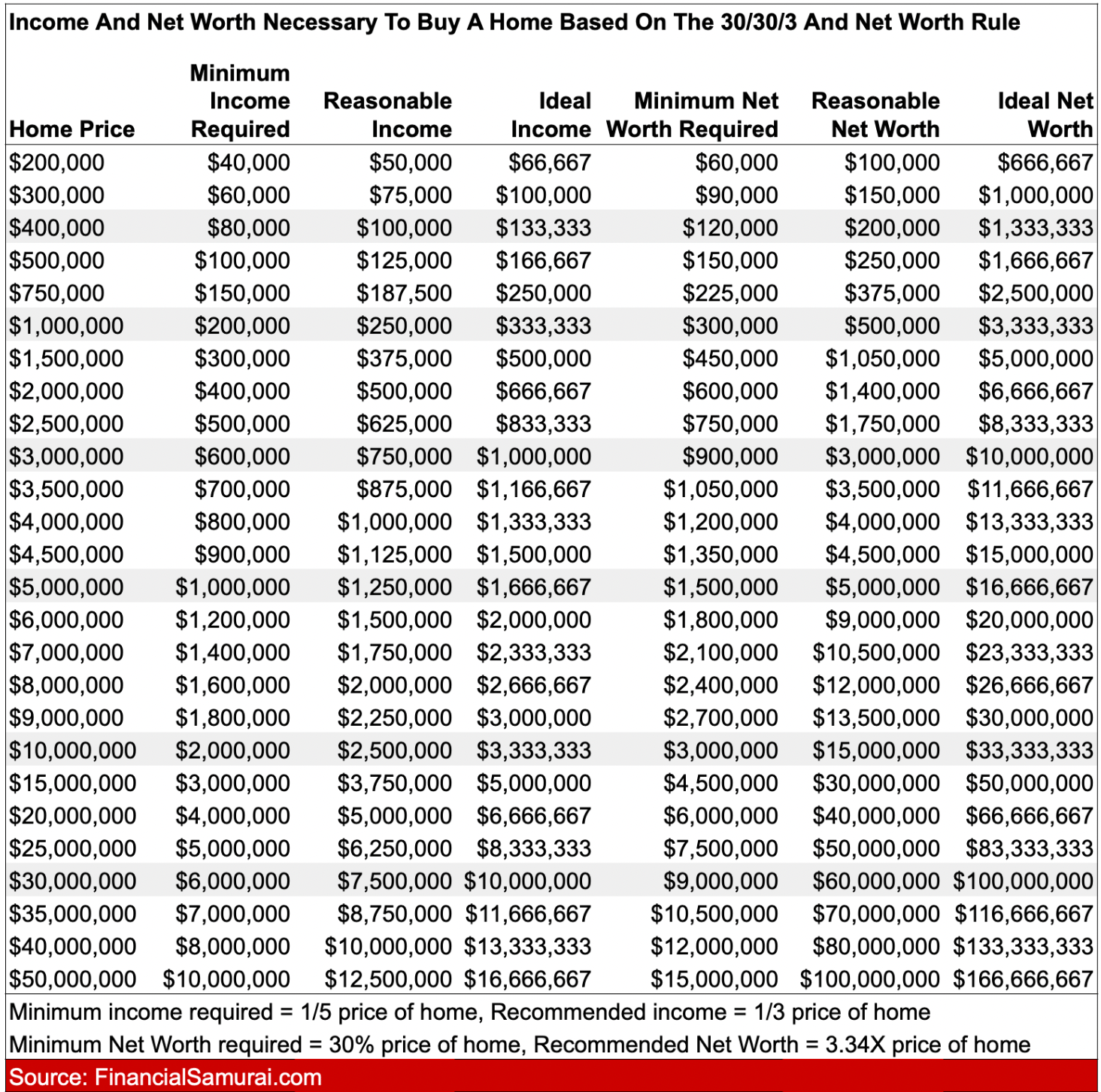

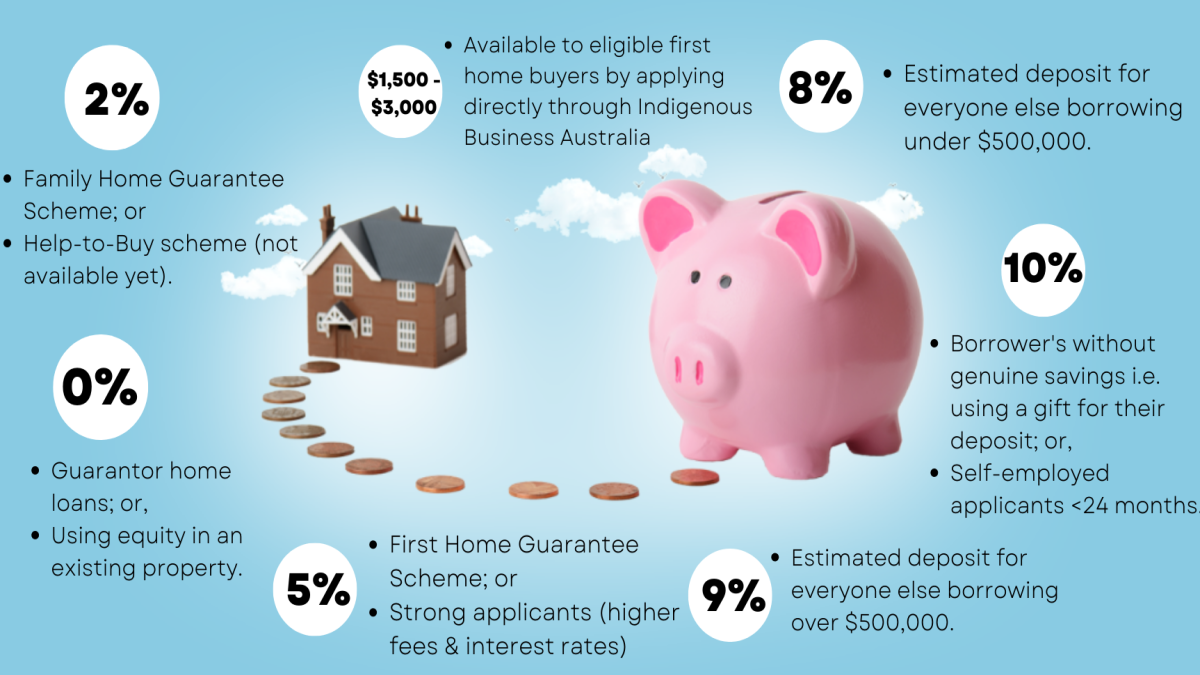

The mortgage down payment is one of the most significant costs when purchasing a home. Generally, it’s a percentage of the total house price that you pay upfront. For many buyers, the standard requirement is a 20% down payment, though some may qualify for lower amounts. Understanding mortgage types is essential as some loans permit down payments as low as 3% to 5%. Before making a purchase, employ a house affordability calculator to determine what fits into your financial scenario while considering the **income requirements for buying a house**.

Understanding Mortgage Types

Different mortgage types can significantly impact your down payment requirement and overall affordability. Conventional loans often require higher down payments compared to FHA or VA loans, which are designed for first-time buyers or veterans. It’s crucial to investigate these options and choose the correct mortgage that allows you to maximize your buying power without jeopardizing your financial security.

Importance of Saving for a Down Payment

Financial planning for home buying typically includes building savings for your down payment. Start by setting up a dedicated savings account that’s only used for this purpose. Consider setting monthly contributions to ensure that you are on track to reach your goal by 2025. Planning early gives you a significant advantage, especially when determining your **estimated monthly mortgage payment** and other housing payment breakdowns.

2. Closing Costs

Closing costs can amount to 2% to 4% of the overall home purchase price. These fees encompass various services, including title insurance, appraisal fees, and the lenders’ processing fees. When understanding closing costs, it’s essential to include them in your home buying budget. Listing these costs will better allocate your funds and avoid surprises at the final settlement table.

Components of Closing Costs

Several expenses form part of your closing costs. A detailed breakdown includes mortgage origination fees, title insurance, escrow fees, and home inspection fees. Be proactive in demanding a summary of anticipated closing costs from your lender, allowing you to evaluate if your local real estate market will present additional costs when buying a house.

Negotiating Closing Costs

In many cases, homebuyers can negotiate some of their closing costs. Speak with your real estate agent about asking sellers to cover certain expenses or allowing you to roll them into your mortgage. Negotiating these figures could ease your financial load as you can dedicate more funds towards your down payment and **savings for home purchase**.

3. Property Taxes

An often-overlooked aspect of house ownership is property taxes. These taxes can vary dramatically based on location, selectively determining how affordable homes in your desired area may be. Being aware of the **cost of home ownership** includes recognizing that these taxes can range from 0.5% to 2% of your home value annually. Hence, proper budgeting for property taxes is essential.

Estimating Property Taxes

Your property tax estimate depends partly on the **home appraisal process** and the local tax rates. Research the average rates in your preferred neighborhood to help shape your budgeting strategy around property tax expenses. Websites often provide calculators that yield an approximate yearly amount against the value of homes based on local averages.

Impacts of Property Taxes on Monthly Payments

Property taxes typically add to your monthly mortgage payments, making it imperative to consider them when calculating your **estimated monthly mortgage payment**. Get the calculations right to determine your budget functionality more smoothly; include both the calculated down payment and the likelihood of increases in your local tax base.

4. Home Inspection Fees

A crucial part of buying a house involves home inspections to guarantee you’re making a sound investment. Home inspection fees usually range from $300 to $500, depending on the property’s size and age. Skipping this step can result in unanticipated repairs that could strain your home buying budget and deter your long-term financial goals.

Finding Reputable Inspectors

When searching for a qualified home inspector, consider recommendations from your real estate agent or doing research based on local **real estate market analysis**. A reputable inspector will provide a thorough assessment, giving you confidence in your purchase decision while identifying any underlying issues that may impact your investment.

How Inspections Affect Future Investments

Home inspections can unveil potential repairs needed and help avoid surprises down the line. A successful inspection may also position you better when negotiating house prices. Remember, being informed will not only assist in your purchase but also provide insights into property management considerations for future investment.

5. Ongoing Homeownership Costs

Beyond the initial purchase, owning a home incurs ongoing costs that buyers often overlook. These include maintenance, utilities, insurance, and potential homeowner association (HOA) fees. Proper budgeting for these costs is vital to long-term home ownership success, especially when calculating the actual costs of your **investment in real estate**.

Budgeting for Maintenance Costs

A good rule of thumb for budgeting maintenance expenses is to reserve 1% of your property’s value annually. This ensures you won’t face unexpected expenses if something breaks or requires replacing. Consider factors such as local climate impacts and property age when determining your ongoing maintenance budget.

Understanding Homeowner’s Insurance

Homeowner’s insurance is crucial when obtaining financing. Lenders often impose a requirement for required coverage to protect investment interest. Comparatively, **insurance for home buyers** can vary significantly; seeking multiple quotes will position you for better negotiation and favorable terms, ultimately making your home more manageable.

Key Takeaways

- Understanding the specifics of your mortgage down payment can influence future savings and budgeting.

- Building up your knowledge about closing costs will assist in preparing for the final expenses when making a purchase.

- Regularly estimating property taxes can help you forecast how home ownership impacts your financial landscape.

- Investing in a proper home inspection can reveal potential repair costs before buying.

- Ongoing homeownership costs play a critical role in your long-term financial strategy.

FAQ

1. What are typical mortgage rates in 2025?

Mortgage rates can vary based on economic conditions, qualifications, and lender decisions. Typically hovering between 3% and 5% historically, it’s vital to stay informed about **mortgage rates** fluctuations that could affect your buying power.

2. How do I calculate my down payment?

To calculate your down payment, multiply the home price by the required percentage. For instance, for a $300,000 home with a 20% down payment ideally, you’ll need to set aside $60,000. Use a home cost estimator or a **house affordability calculator** to input various percentages based on mortgage conditions.

3. Are there any programs for down payment assistance?

Yes! First-time buyers often have access to down payment assistance programs or grants that help fill the gap for **savings for home purchase**. Check with local housing authorities and organizations that support neighborhoods; they typically manage such programs directly.

4. How can I find additional costs for home buying?

Utilizing resources like a real estate agent or comprehensive online home buying guides can make understanding **additional costs for home buying** easier. Real estate commissions, title fees, and various state requirements also play critical roles in your financial strategy. See reliable websites or links connected to housing finance strategies to deepen your knowledge.

5. What factors affect my eligibility for a mortgage?

Your credit score, income, and debt-to-income ratio directly influence your mortgage eligibility. Understanding these criteria alongside **financial requirements for home buying** will enhance your chances of securing a favorable loan.

Images: