Discover How Much Cash App Charges to Cash Out in 2025: A Comprehensive Guide to Fees and Options

Discover How Much Cash App Charges to Cash Out in 2025: A Comprehensive Guide to Fees and Options

Understanding Cash App Cash Out Charges

Cash App provides a convenient platform for users to manage their finances, but understanding **Cash App cash out charges** is crucial for maximizing its benefits. In 2025, the **fees for cashing out Cash App** have evolved, reflecting changes in the app’s fee structure. When you initiate a **Cash App withdrawal**, knowing what to expect in terms of charges and transfer times can help you plan effectively. Users typically have two main options for withdrawing their balances: standard withdrawals and instant transfers.

Cash App Withdrawal Fee Structure

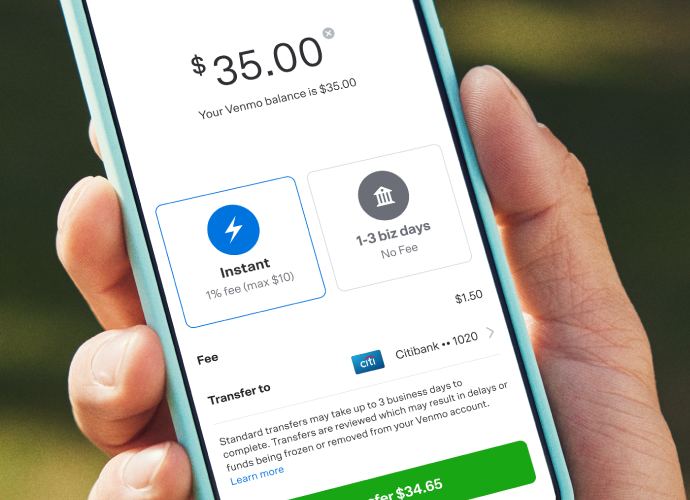

The **Cash App withdrawal fee** can vary based on the method chosen. For example, a standard transfer takes 1-3 business days and is free, which is beneficial for those who are not in a rush. However, opting for an immediate withdrawal will incur a **Cash App instant transfer fee** of 1.5% of the amount you are cashing out. For larger withdrawals, these fees can add up significantly, so it’s wise to consider your transaction history and withdrawal habits.

Cash App Cash Out Limit and Options

When utilizing Cash App, users must be aware of the **Cash App cash out limit** which is currently capped at $250 per transaction for instant withdrawals. This means that users planning to **transfer money Cash App** may need to break down their withdrawals if they have a larger balance. Alternatively, users can withdraw up to $1,000 within a 30-day period via standard methods. Understanding these limits helps to effectively manage your **Cash App balance withdrawal**.

How to Cash Out on Cash App Effectively

Cashing out of **Cash App** should be a straightforward process, provided users familiarize themselves with the steps involved. Here, we’ll walk you through how to **cash out on Cash App** wisely, minimizing any potential fees.

Step-by-Step Guide to Cashing Out

To initiate the **Cash App cash out process**, start by opening your Cash App and navigating to the “My Cash” tab. Follow these steps for a successful withdrawal:

- Tap the “Cash Out” option to access your balance.

- Decide how much you wish to withdraw, keeping in mind any applicable limits.

- If you opt for instant cash out, the fee will be displayed before confirmation.

- Complete the process by tapping “Cash Out” and selecting your preferred method.

This simple guide provides a clear pathway for users to make informed decisions, particularly when weighing the implications of the **Cash App fees for withdrawal**.

Cash App Security Features for Withdrawals

Understanding the safety layers around **Cash App financial transactions** is just as essential as grasping the fee structure. Cash App employs various **security features** to protect users while executing transactions. Features like **two-factor authentication**, the **ability to suspend your account**, and **encryption technologies** are crucial for safeguarding your funds. Regularly reviewing your transaction history and ensuring the email and mobile numbers linked to your account are current play a vital role in maintaining your account security while using Cash App.

Comparing Cash App with Other Payment Platforms

The landscape of mobile cash transfer applications is competitive. Thus, understanding how Cash App fares against other platforms like Venmo or PayPal in terms of fees can guide your decision-making. For instance, both Venmo and PayPal also charge varying rates for cash out transactions, and assessing these can highlight the best choices for your needs.

Cash App Fees Comparison

In a direct comparison with competitors, **Cash App transaction costs** tend to be more transparent. While Venmo doesn’t charge for standard withdrawals either, its instant transfers similarly attract a risk of fees. An essential factor here is that Cash App does not have annual or monthly account management fees, offering appealing value for users who want to avoid **app fees** that a service like PayPal may impose.

Best Practices for Using Cash App

To maximize benefits with Cash App while avoiding unnecessary **Cash App transaction fees**, consider the following tips:

- Opt for standard withdrawals whenever feasible to avoid instant transfer fees.

- Keep track of your limits to streamline your financial activities.

- Maintain adequate security on your account to prevent unwanted access.

By implementing these best practices, users can ensure they’re getting the most value out of their Cash App experiences.

Key Takeaways

Understanding the nuances of **Cash App withdrawal fees** is vital to making the most out of your transactions. Always consider the following:

- Know the cash out limits and choose the suitable transfer method.

- Use standard transfer options when not in immediate need of cash.

- Stay aware of the transaction fees associated with various transfer options.

FAQ

1. What are the fees for cashing out on Cash App?

The **Cash App cash out charge** includes a standard withdrawal that has no fees and takes typically 1-3 business days. Alternatively, instant transfers incur a fee of 1.5%, making it crucial to determine your need for speed versus saving costs.

2. How do I check my Cash App balance?

After opening your Cash App, navigate to the “Home” screen. Your existing balance will be visible at the top of the screen. It’s important to stay aware of your balance, especially before considering any **Cash App balance withdrawal**.

3. Can I withdraw more than $1,000 from Cash App in 30 days?

No, Cash App limits users to withdraw up to $1,000 within any 30-day period through standard methods. However, you can request another $1,000 at the start of a new 30-day cycle, allowing careful planning ahead.

4. Is there a way to avoid transaction fees on Cash App?

To avoid **Cash App transaction fees**, consider using standard transfers instead of instant transfers. Regular withdrawals do not incur any fees, making them a more budget-friendly option.

5. How does security work for Cash App withdrawals?

**Cash App security features** include two-factor authentication, encryption, and user alerts to ensure the integrity and safety of transactions, thus giving users peace of mind while managing their finances.