Essential Guide to How to Calculate Beta in Modern Finance: Discover Proven Methods to Analyze Risk in 2025

Essential Guide to How to Calculate Beta in Modern Finance

Understanding how to calculate beta is fundamental for investors and analysts in 2025. Beta, an essential measure of an investment’s risk relative to the market, plays a critical role in finance beta, influencing investment strategies and decisions. In this article, we will explore proven methods to analyze risk, discuss the beta formula, and delve into the significance of beta metrics in finance.

What is Beta and Its Definition

Beta is a statistical measure that represents the relationship between the return of a stock and the return of the market. Specifically, it indicates the stock’s volatility or risk in comparison to the overall market, typically defined with a beta value of 1 representing the market itself. A beta coefficient greater than 1 signifies that the stock is more volatile than the market, meaning it is subject to larger fluctuations in price. For instance, a stock with a beta of 1.5 is expected to move 1.5% for every 1% move in the market. Conversely, a beta value below 1 indicates less volatility than the market. Understanding beta is crucial for risk assessment beta, helping investors gauge potential investment risks. With proper beta calculations, investors can adjust their expectations and strategies accordingly to fit their risk tolerance.

Types of Beta

There are several types of beta that help investors understand different aspects of risk. The most common types include:

- Equity Beta: Most prevalent in stock analysis, it reflects a stock’s volatility compared to the market.

- Asset Beta: Represents the risk of assets used in a business, factoring in the capital structure.

- Debt Beta: Measures the risk associated with corporate debt.

By recognizing these distinctions, investors can better tailor their investment beta strategies, leveraging it to assess portfolio volatility effectively.

Understanding the Beta Formula

The beta formula is quite simple yet powerful:

Beta (β) = Covariance(Ri, Rm) / Variance(Rm)

Where:

Ri = return on the stock

Rm = return on the market

This formula helps in calculating beta using historical returns of both the market and the particular stock. It allows analysts to derive the beta value effectively, aiding them in conducting beta analysis for expected returns and further risk assessment. Using software tools, you can easily execute the beta computations based on historical price data to derive meaningful insights.

Calculating Financial Beta: Proven Methods

When it comes to calculating beta, various methodologies can be employed. Each method comes with its advantages and specific applications. Here are three proven strategies:

1. Historical Beta Calculation

One of the most frequent methods of calculating financial beta is through historical price data analysis. This involves downloading historical returns for both a stock and the benchmark index (often the S&P 500) over a set period, typically two to five years. Afterward, investors conduct a regression analysis to determine the beta coefficient from the data set. This method yields a beta that emphasizes past performance, making it valuable for evaluating potential investments. Additionally, utilizing historical beta involves an understanding of whether specific time frames yield more reliable results when assessing beta volatility.

2. Adjusted Beta Calculation

An adjusted beta utilizes the standard historical beta but modifies it to account for the regression toward the market beta of 1.0 over time. The mathematical representation of adjusted beta is:

Adjusted Beta = (0.67 * Historical Beta) + (0.33 * 1)

This adjustment is particularly useful in risk management, as it accounts for mean reversion, making it beneficial for investors focusing on long-term holding strategies. Adjusted beta gives a more conservative estimate, potentially reducing the over-likelihood of extreme predictions in performance measurement.

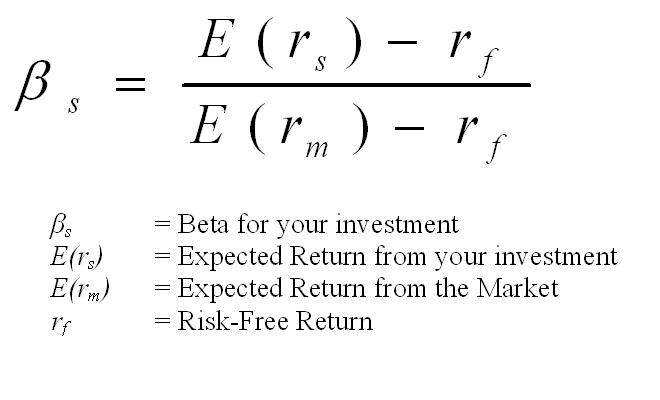

3. Utilizing CAPM for Beta Measurement

The Capital Asset Pricing Model (CAPM) further reinforces our understanding of the beta’s relevance in finance. This model explores the correlation between risk and expected return, using beta in its formula for determining the expected return of an asset. The equation is as follows:

Expected Return = Risk-Free Rate + Beta * (Market Return – Risk-Free Rate)

This methodology aids in pinpointing the worth of investment risks based on beta implications. Investors frequently incorporate CAPM to diversify their portfolios by selecting stocks with desirable beta values aligned with their risk tolerance, following a structured investment portfolio construction approach.

Benefits and Implications of Using Beta

Understanding and effectively calculating beta has a multitude of advantages for investors. By comprehensively analyzing this metric, investors are better equipped to make informed decisions regarding asset allocations, portfolio volatility, and risk management strategies. Below are some significant benefits of utilizing beta in finance:

Evaluating Investment Risk

Beta serves as an invaluable tool for evaluating investment risk. By analyzing beta risk, investors can ascertain whether certain assets are aligned with their investment goals and risk profiles. High-beta stocks present substantial upside potential but carry inherent volatility. On the contrary, low-beta stocks—traditional in defensive sectors—carry less risk, making them compensatory in bearish trends or downturns in stock market correlation.

Market Benchmarking and Performance Attribution

Another key benefit involves market benchmarking. Investors can benchmark their portfolios against market indices effectively, measuring performance against expected returns based on calculated beta. These beta computations allow for precise performance attribution, clarifying the drivers of portfolio returns and helping refine investment performance metrics. Thus, beta analysis helps control and realign investment strategies over time.

Building a Diversified Portfolio

Market analysis of beta provides insight into diversifying investments across different asset classes. By choosing a mix of high and low-beta stocks, investors build a more resilient portfolio, essentially improving the risk-adjusted return and mitigating possible pitfalls from market volatility. Effective implementation of beta diversification reduces company-specific risks, aiding empowerment for asset management approaches.

Key Takeaways

- Beta is critical for understanding stock volatility relative to the market.

- Effective methodologies for beta calculations include historical beta, adjusted beta, and CAPM.

- Utilizing beta helps evaluate investment risk, market benchmarking, and portfolio diversification.

- Beta value impacts investment strategies and reinforces risk management practices effectively.

FAQ

1. What is the significance of beta in finance?

Beta provides insights regarding the volatility of a stock compared to the market. It helps investors in risk assessment and aids in determining whether a stock fits with their investment strategy based on expected return as per the beta coefficient.

2. How can I calculate adjusted beta for my investments?

To calculate adjusted beta for your investments, apply the formula: Adjusted Beta = (0.67 * Historical Beta) + (0.33 * 1). This calculation mitigates extreme volatility effects while taking a more conservative approach for long-term investments.

3. What does a beta greater than 1 indicate?

A beta greater than 1 indicates that the stock is more volatile than the market. It suggests that the stock will experience larger price movements and thus may attract higher potential returns alongside increased risk.

4. How does CAPM relate to beta analysis?

CAPM incorporates beta in calculating the expected return on an investment. This model balances risk and return, enabling investors to understand how additionally adjusting risk through assets can lead to expected investment valuations.

5. Is it possible to have a negative beta? If so, what does it mean?

Yes, a negative beta indicates that a stock moves inversely relative to the market. Such stocks can provide protection during market downturns but generally come with lower returns correlated with systematic risk attributes.

6. What role does beta play in portfolio construction?

Beta plays a crucial role in portfolio construction by allowing investors to assess the expected volatility and risk associated with the total portfolio’s exposure to market movements, aiding in strategic decision-making for asset allocation.

7. How can historical beta predict future stock performance?

Historical beta examines past correlations between stock and market performance, giving investors metrics and insights for forecasting future behaviors under similar market conditions if maintained historically consistent.