How to Get a Certified Check in 2025: Essential Steps to Secure Your Funds

How to Get a Certified Check in 2025: Essential Steps to Secure Your Funds

Obtaining a certified check is crucial for many financial transactions, ranging from secure payments to closing real estate deals. As a guaranteed payment method, the certified check process offers safety and reliability, making it an essential tool in various scenarios. This guide will walk you through the essential steps on how to get a certified check, ensuring you’re well-equipped to handle your transactions in 2025.

Understanding Certified Checks

A **certified check** is a type of check guaranteed by the issuing bank, ensuring that the funds are available at the time of issuance. This characteristic sets it apart from personal checks, which may bounce if the account has insufficient funds. Thus, understanding certified check definitions can help you navigate financial needs with confidence. They are ideal for transactions where security and trust are paramount, such as **certified check for deposits** or purchases.

What is a Certified Check?

Essentially, a certified check is a personal check that a bank guarantees. When a bank certifies a check, it verifies that the account holder has enough funds in their account to cover the amount written on the check and marks it to indicate this guarantee. This action adds an additional layer of security, making certified checks a preferred payment method for significant transactions. Understanding the certified check process can help you make informed decisions when dealing with large payments or securing agreements.

Benefits of Using Certified Checks

There are notable advantages of getting a certified check, primarily the enhanced security it offers. Because certified checks are guaranteed by the bank, recipients can have confidence that the funds are secured. This is particularly important for transactions like **certified checks for rental agreements** or **certified checks in business** contexts. Additionally, they help in establishing trust in professional relationships and can make approvals for larger deals—such as purchasing a home or vehicle—more seamless.

Steps to Get a Certified Check

Follow these essential steps to secure your own certified check, simplifying what might seem like a daunting process.

1. Visit Your Bank or Credit Union

The first step in the certified check request process is to visit your local bank or credit union. Most financial institutions offer the service, but it’s critical to call ahead to confirm their **certified check policy**. Whether you’re looking to obtain a certified check from a local bank for personal use or for business transactions, each institution might have its requirements.

2. Prepare the Necessary Documents

When obtaining a certified check, banks typically require certain documents. You’ll need valid identification, such as a driver’s license or passport, and may also need to complete a **certified check application form**. Having your account details ready will speed up the process further. Understanding certified check requirements for personal use ensures that you’ve got everything prepared ahead of your bank visit.

3. Fund Your Check

Before you can receive a certified check, ensure that you have sufficient funds in your account. The bank will deduct the check amount from your account immediately, effectively locking those funds until the check is cashed. This is a crucial step in the certified check issuance process, leading to a safe transaction for both parties.

4. Pay Applicable Fees

Be prepared to pay certified check fees that vary by bank. It’s wise to inquire about these fees ahead of time, as they can differ significantly between institutions and can be flat fees or a percentage of the total check amount. Understanding **certified check costs** will help you budget accordingly and avoid unexpected expenses during transactions.

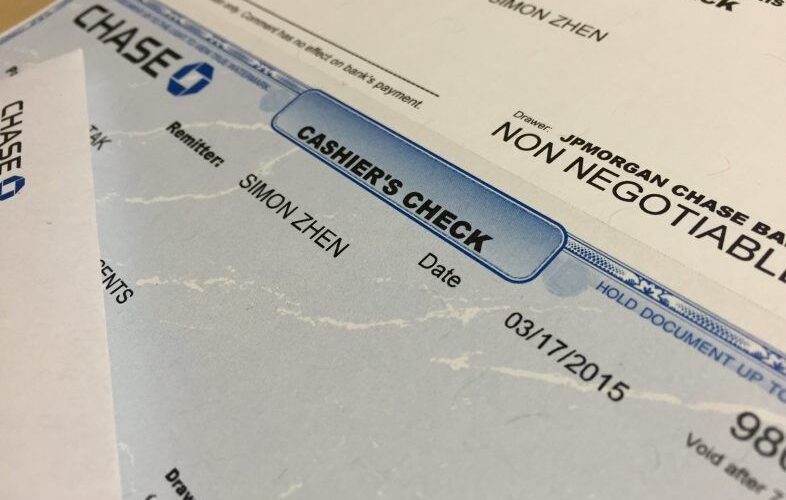

Certified Check vs. Cashier’s Check

When navigating secure payment methods, many ask about the difference between a certified check and cashier’s check. Knowing this can help you determine which to use based on your financial needs.

Comparison of Payment Methods

Banks issue cashier’s checks at their own expense. The bank takes funds directly from its account, while a certified check draws from the account holder’s funds. As a recipient, you may prefer a certified check for personal transactions since it reflects a verified commitment from the individual payer. On the other hand, knowing when to use certified checks versus cashier’s checks in business settings can ensure you choose the most suitable option for your needs.

When to Choose a Certified Check

Utilizing certified checks effectively typically applies in situations requiring a **guaranteed payment method**. For instance, when applying for a rental agreement or making a significant purchase, presenting a certified check allows you to solidify your commitment without the risk of bounced payments. Recognizing certified check features in diverse contexts can lead to better financial decisions and strengthen your transaction safety.

Ensuring Transaction Security

Safeguarding your transactions when using certified checks should be a top priority. Here are important tips for maintaining certified check transaction security.

Secure Handling of Certified Checks

Practice **certified check safety tips**, such as keeping your checks in a secure place and avoiding sharing your account information unnecessarily. Regularly check your bank statements for unauthorized transactions too. Armed with **certified check tips for safe handling**, you can significantly reduce the chances of fraud or misuse.

Verification Process of Certified Checks

Always verify the authenticity of a certified check before accepting it. Banks maintain a verification process for these checks; by contacting the issuing bank directly, you can confirm details such as the account status and ensure the funds are legitimate. Familiarize yourself with the **certified check verification** process to boost your safeguarding efforts during transactions.

Return Policy and Handling Fees

Learn about the return policy if a certified check doesn’t clear due to technical errors. Each bank has internal rules, and clarity on that could save you from potential future headaches. Additionally, knowing certified check handling fees can simplify your budgeting for transaction costs and help you plan accordingly.

Key Takeaways

- A certified check guarantees funds, making it a secure payment for large transactions.

- Understand and follow the certified check request process, including necessary documents and fees.

- Choose certified checks over cashier’s checks depending on the transaction context for better security.

- Maintain security by verifying check authenticity and securely handling all checks.

FAQ

1. What are the requirements for obtaining a certified check?

To obtain a certified check, you typically need to provide a valid ID, have enough funds in your account, and complete a certified check application. It’s prudent to check with your bank for specific requirements.

2. Can I get a certified check online?

Many banks offer online certified check services, allowing you to request them through your online banking system. However, this can vary among institutions, so it’s important to check with your bank directly.

3. How long does it take to process a certified check?

The processing time for a certified check is usually immediate, as funds are deducted from your account when the check is issued. However, how long it takes to clear once deposited can vary based on bank policies.

4. Are certified checks considered safe for large transactions?

Yes, certified checks are considered safe due to the bank’s guarantee of funds. However, always verify a certified check’s authenticity by contacting the issuing bank before completing any large transaction.

5. Can certified checks be used for international transactions?

While certified checks are commonly used domestically, using them for international transactions may require additional verification steps and may be subject to various banking fees. It’s best to consult your bank for guidelines on international use.

For further reading on improving your certification check knowledge and conducting secure transactions, visit here and here.